I recently watched a video listing top books for financial success. I had read many of the books, and shared thoughts on some of them before, but had never read the Howard Marks book, The Most Important Thing: Uncommon Sense for the Thoughtful Investor. Marks co-founded Oaktree Capital Management in 1995 and remains Chairman of the Board. The California firm currently has $205 Billion in assets under management and Marks is a self-made billionaire. The forward by Warren Buffet states, “This is that rarity, a useful book.” I tend to agree!

Below I share my notes from the book and then look at how the ideas apply to our current (end of January 2025) financial markets. Please do not consider anything in this post specific financial advice, but I am going to utilize these concepts in my future investment decisions. If you enjoy my summary of key takeaways, I suggest you read the book!

The Most Important Thing is . . . Understanding Market Efficiency

The first key takeaway (for me anyway) is understanding that many individuals and organizations devote their careers to making money in the markets. It is going to be hard for a person like me to beat these experts. That is why low-cost index investing and dollar cost averaging techniques work well for lay investors.

Marks then notes many periods in time where market prices are far above or far below intrinsic values. In other words, even the experts fall victim to market cycles (described below) and buy at the top of the market or sell when the market is at a low point.

In order to become a better than average investor you need to use second-level thinking to ignore the popular sentiment and do the opposite of the masses. You can’t always do the same thing others do and expect to outperform them. The Most Important Thing: Uncommon Sense for the Thoughtful Investor shares how to become a second-level investor.

The Most Important Thing is . . . Value

The oldest rule in investing is also the simplest: buy low and sell high. Of course, to do that, you’d better have a good idea of what intrinsic value is. For Marks, an accurate assessment of the value of the security is the starting point.

With millions of people analyzing similar information, how often will stocks become mispriced, and how regularly can one person detect those mispricings? Marks’s answer: “Not often, and not dependably.”

An investor has two basic choices:

- Gauge the securities’ underlying intrinsic value and buy or sell when the price diverges from it (value investing)

- Base decisions purely on expectations regarding future price movements (growth investing)

Marks believes the latter option is based on either superior information or luck and does not work.

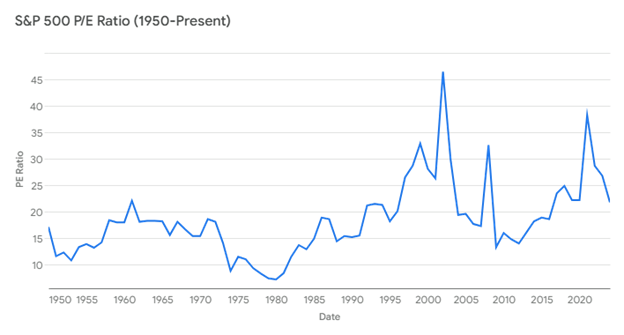

Investment success doesn’t come from “buying good things, “but rather from “buying things well.“ To achieve superior investment results, you have to hold non-consensus views regarding value (since every buyer needs a seller) and you have to be right. In other words, price matters! The P/E ratio, or ratio of Price to Earnings for the holding, is a common metric for individual holdings or entire markets. Here is a view of P/E ratios for the S&P 500 over the past 75 years.

As I write this post, Tesla stock has a P/E ratio of over 100. This means that the price I will need to pay for Tesla shares is over 100 times more than the earnings per share. Investors are unlikely to make money at this P/E ratio unless they are lucky enough to sell to other suckers who will pay a higher price. They might find these people – for a time. Eventually, the price is likely to return to provide a P/E ratio closer to normal.

The Most Important Thing is . . . Understanding Risk

Every successful investor must also understand, recognize, and control risk.

Marks points out that you must consider risk when comparing the returns of an investment. Consider these three scenarios:

| Investment A | 20% annual return | Angel investment in a startup biz |

| Investment B | 10% annual return | Stock in a single growth company |

| Investment C | 5% annual return | FDIC insured bank savings account |

Which return above is the best? Different investors may have different answers to this question, but many would prefer the guaranteed 5% return rather than risking a potential decrease in the value of the stock or a total loss in the angel investment. Risk is better understood when you know the intrinsic value of the investment you are making.

Surprisingly, good returns are often just the flipside of surprisingly bad returns. One year with a great return can overstate the manager’s skill and obscure the risk he or she took. Yet people are surprised when that great year is followed by a terrible year.

Over a lifetime of investing, your results will have more to do with the sizes of your losses than the magnitude of your winners. Marks recommends investors act defensively, staying in the game and avoiding a major loss. Remember, a 100% return on your investment followed by a 50% loss leaves you right where you started!

The Most Important Thing is . . . Being Attentive to Cycles

Markets are like pendulums that swing from one side to the other. The market will move from undervalued to overvalued and back again. Many investors, and especially their clients, will be excited and optimistic when the market is performing well (at the top) and pessimistic and scared when the market is performing poorly, and people are selling (at the bottom).

The occurrence of this pendulum-like pattern in most market phenomena is extremely dependable. But just like the oscillation of cycles, we never know:

- how far the pendulum will swing in its arc,

- what might cause the swing to stop and turn back,

- when this will occur, or

- how far the pendulum will then swing in the opposite direction.

Market cycles present the investor with a daunting challenge, given that:

- Their ups and downs are inevitable.

- They will profoundly influence our performance as investors.

- They are unpredictable as to the extent and especially timing.

In the world of investing, nothing is as dependable as cycles. The most important thing is having a sense for where we stand in the current cycle.

The Most Important Thing is . . . Second-Level Thinking

Second level thinking combines Marks lessons from The Most Important Thing: Uncommon Sense for the Thoughtful Investor into a strategy. Here is how I summarize it:

- Seek to understand the value of any investment. If it is an index fund, consider the P/E ratio. If an individual company, understand the underlying value of the business.

- If you don’t understand the above, stick to low-cost index investing and dollar cost averaging.

- If you understand the basics of intrinsic value, realize that overvalued assets are much riskier than undervalued assets. Either hedge your bets or look for less risky investments.

- When the market is at a high point in the cycle, do your best to resist buying in and instead keep your money ready for the cycle to shift.

- When the pendulum does swing and investments become a better value, BUY. As Warren Buffet says, “Be greedy when others are fearful and fearful when others are greedy.”

Marks has this to say about his firm, Oaktree Capital Management:

“It’s our job to catch falling knives, hopefully with care and skill. That’s why the concept of intrinsic value is so important. If we hold a view on value that enables us to buy when everyone else is selling – and if our view turns out to be right – that’s the route to the greatest rewards earned with the least risk.”

In closing, one of the biggest challenges to second-level thinking in investing is doing the opposite of most investors.

Here are some of the ways Oaktree combats negative influences:

- a strongly held sense of intrinsic value

- insistence on acting as you should when prices diverge from value

- a promise to remember that when things seem “too good to be true,” they usually are

- willingness to look wrong while the market goes from misvalued to more misvalued (as it invariably will)

- like-minded friends, and colleagues from whom to gain support

Summary

The Most Important Thing: Uncommon Sense for the Thoughtful Investor was written many years ago, and I wondered how the author would apply his concepts to the market today. I found a January 7, 2025 post by Howard Marks sharing his thoughts on the current market situation. I can report that his 2025 post is fully consistent with the lessons in his 2011 book!

Let us know your thoughts on this summary in the comments below. Do you disagree with any of these ideas?