We recently suggested strategies for Putting Lazy Money to Work for You, a topic related to Rule 7 of the Personal Kaizen 10 Rules for Life. We shared that “cash is trash” and showed how inflation destroys the spending power of your money. The best strategy is to make your money work for you by investing it. Here are 5 low-cost investment strategies that will help you retire comfortably or even achieve FIRE – financial independence to retire early!

Note that I am not a financial advisor – these are all just personal opinions. Also, note that I am not compensated in any way for this advice.

1. The Only Thing You Can Know for Sure About Your Investment is the Cost

All investments are subject to unknowns and risks. For example, we don’t know how much a stock will pay in dividends to the shareholder. Likewise, yields and interest rates will change over time. We can’t know how an investment will appreciate in value (so that we can sell the investment for more than we paid).

One of the only things we do know about our investment is the cost we pay to the firm, institution, etc. that holds and manages the investment. This cost is always a loss to us whether the investment gains value or loses value. Therefore, always try to reduce the cost you pay for the investment.

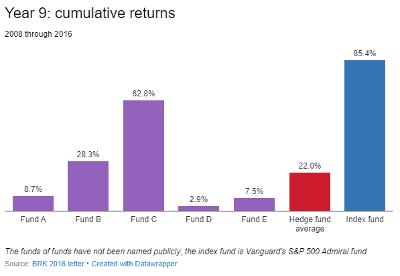

Investor Warren Buffett famously exposed how investment fund costs drag down the value of an investment when he bet hedge fund investor Ted Seides that a mix of hedge funds selected by Seides would fail to outperform an S&P500 Index fund in the ten years from 2008 to 2018. The results of the bet (that Ted Seides conceded a year early) are shown in this graph from Investopedia below:

Buffett wanted to demonstrate the value of owning an index fund for the average investor and highlight the hefty fees that hedge funds charge. He won the bet easily and donated his $2.2 million of winnings to charity.

2. Market Timing is for the Experts, but They Are Often Wrong

Most investments increase or decrease in value based on various conditions and variables. A few experts exist with teams of people who try to understand these variables and make decisions based on the market conditions. I guarantee these experts are more knowledgeable than you and I, dedicate more time to this work, and have more resources and data than us. It is silly to think that we are somehow smarter than them.

It is also true that these experts often are wrong (see the chart above). What is an average investor like us to do?

Dollar-cost averaging is a great way for the average person to invest. You ignore the economy and market news and just invest the same amount of money in the same low-cost index fund. If the cost of your investment has gone up then congratulations – your investment has made money. If the cost has gone down then it is even better news – you are able to buy more shares this purchase!

3. You are Not Going to Beat the Experts – or Probably Pick the Right One!

Photo Credit: VOO Vanguard S&P 500 ETF

The graph above demonstrated the different outcomes an investor would have by selecting any one of the funds. Paying Hedge Fund D to manage all of your money would have been especially disappointing!

Index funds are a great way for the average investor (and even the mega-rich) to maximize their returns. Index funds are designed to track an index (like large US companies, bond funds, smaller companies, international markets emerging markets, etc.) and regularly rebalance the fund to track the index. An investor buying a share of the S&P 500 is buying a small piece of all 500 companies that make up that index. This link shows you what a common S&P 500 index fund owns today.

Index funds were first created by Jack Bogle, the founder, and CEO of The Vanguard Group. Average investors who practice his general investment advice are “bogleheads” and share many free resources on investing.

4. A Dartmouth Lesson on Diversifying to Reduce Risk

Roughly 20 years ago I attended a Dartmouth College session on investing as part of my degree program. The Tuck Business School professor taught about risk-adjusted return and the importance of diversifying your investments.

If you invest in a single stock then success in your investment is only dependent on the performance of that stock. Spreading your risk around multiple stocks will reduce your overall risk.* Ever since this lesson I have avoided buying individual stocks and focused instead on buying low-cost funds that hold multiple stocks.

Eliminating an investment loss is more important than most people realize. A 20% loss in investment requires a 25% gain just to break even, and a 50% loss requires a 100% gain later to return to your starting point! Do the math for yourself to see this.

5. Ignore “Paper Losses”

Most investments will fluctuate in value. Your current portfolio value is equal to the investments you have multiplied by the market value of each investment share.

My personal portfolio value has dropped by over 12% since the beginning of 2022, despite biweekly investments into the account. This is a significant loss to the overall value of my account and worth many thousands of dollars. Should I be concerned with this drop? Should I sell these investments to prevent further losses?

Most stocks and bonds, for example, have zero fees when buying and trading them.

The basic lesson for me was this: every additional stock you own in an investment is likely to decrease your overall risk slightly. Therefore, owning a broadly diversified investment in many areas will reduce your overall risk.

Low-cost Investment Strategies

Putting it all together, here are our ideas for action:

- Make regular investments in several low-cost index funds. Make these investments automatically withdrawn from your paycheck. Some popular funds include VTI, VOO, and FNILX.

- Invest this money in retirement accounts (like a 401(k) account or an individual retirement account) up to your maximum allowable investment. These accounts allow you to avoid paying taxes on the gains.

- If you still have money available to invest, invest this in low-cost index funds but be prepared to pay taxes on your gains when you sell.

- Do not worry about the value of your portfolio until you are within 5-years of withdrawing the money. If the value goes down you should be happy – just think of the fund as being on sale!

Summary

If you are new to investing the key is to get started. The low-cost investment strategies above require little time and effort and have historically been very successful. It will take you some time to get to an account value of over $100,000, but once you get there you start to see more rapid gains. The results of compound interest, automatically reinvesting dividends, tax-advantaged accounts, and regular investing can make you a millionaire faster than you think!

* This footnote could be a few pages long. If you have multiple investments that are all in one area you really haven’t reduced your risk as much as you may think. Also, Warren Buffett has become rich by value-investing: purchasing a stock or company when the market value is low relative to the perceived value of the assets. While Buffett has succeeded in this way, he acknowledges that he has access to capital and opportunities that average people do not. He recommends the rest of us to invest in low-cost index funds.

No comment today.