I read many financial investment books and follow many personal investment blogs and podcasts. My learnings haves been incorporated into Rule 7 of my 10 Rules for Life: To be rich, spend money on what you love. I have seen advice recently that suggests that there is little difference between investing in index funds and exchange traded funds (ETFs). Wrong! I’m about to teach you how you may be able to increase your returns by buying ETFs instead of index funds. My trick has helped me earn an extra 1% on recent purchases, and several thousand dollars over the past few months. Learn how I did it below!

ETFs versus Index Funds

Let’s begin with a description of ETFs and Index funds and key differences between them. I’ll use my favorite fund for this example: the Vanguard Total Stock Market fund.

VTI is the ETF version of the Vanguard Total Stock Market. VTSAX is the mutual fund version. Both these funds seek to replicate the performance of the CRSP U.S. Total Market Index, which represents the entire U.S. stock market by including stocks from various sectors and market capitalizations. Both funds own 3,598 different stocks in the fund and the top holdings and splits are essentially identical. Returns are also essentially identical (except for the slight cost difference), as shown below.

| Metric | VTI | VTSAX |

| AUM | $283.1B | $283.1B |

| Expense Ratio | 0.03% | 0.04% |

| 1-yr return | 1.33% | 1.31% |

| 3-yr return | 13.94% | 13.93% |

| 5-yr return | 10.51% | 10.50% |

| 10-yr return | 11.61% | 11.61% |

Both VTI and VTSAX are low-cost index funds that are not actively managed (actively managed funds have higher fees than index funds). These funds have almost identical holdings and returns. The only difference is that VTSAX has a cost of 0.04% while VTI is even lower at 0.03%. Both these funds have no load fees, meaning they have no commission costs when you buy or sell them. Some funds have this extra fee – avoid funds with load costs!

The Differences Between ETFs and Index Funds

The key differences between these two funds, and between index funds and ETFs in general, are:

- ETFs like VTI trade on the exchange, meaning that the price fluctuates during the day. Index funds and other mutual funds are typically priced and traded only once per day after the market closes. Trading used to be through the fund company itself (saving you on trading costs) but commission free trading is now common for ETFs as well.

- Exchange traded funds can trade using options that limit the price you buy or sell the shares. This is important, as you will soon see!

- ETFs tend to be more tax-efficient than mutual funds. Their unique “creation/redemption” process can minimize capital gains distributions to shareholders. When mutual funds sell securities to meet redemptions, it can trigger taxable events for all shareholders, even if they haven’t sold their own shares. ETFs have a mechanism to handle inflows and outflows of investments with fewer taxable events.

- ETFs trade like stocks while most mutual funds have a minimum initial investment. VTSAX, for example, has a minimum initial investment of $3,000.

- Many ETFs have lower costs than a mutual fund. As stated above, VTI is 0.01% less expensive than VTSAX. That is only saving you $10 annually for every $100,000 you have invested, but it is better than nothing!

A Real Example: Buying an Index Fund in 2025

Here is how I increased my returns by several thousand dollars by buying EFTs instead of index funds. In this example let’s assume that I have $100,000 to invest from a rollover and I want it all in a Total Stock Market Index (buying either VTSAX or VTI).

Index fund example (buying on April 16,2025 versus the value on May 12, 2025):

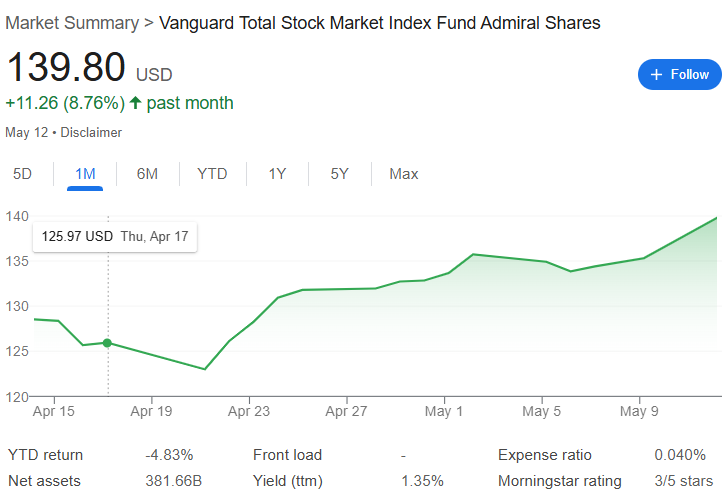

- I took my large rollover of $100,000 into my account and decided to buy shares of VTSAX. Placing my order on Thursday morning means that I will purchase the shares on Friday based on whatever price the index fund closes at on Thursday afternoon. On Thursday morning the price is $125.68 per share.

- By Friday morning the price is $125.97 per share and my $100,000 buys me 793.84 shares of the fund. I was unlucky and the price increased slightly, meaning I bought a few less shares.

- Monday May 12 is a great day on the market and the value of VTSAX closes (after 6 PM) at $139.80 per share. My 793.84 shares are now valued at $110,978.

How to Increase Returns Buying ETFs Instead of Index Funds

ETF example (buying on April 16,2025 versus the value on May 12, 2025):

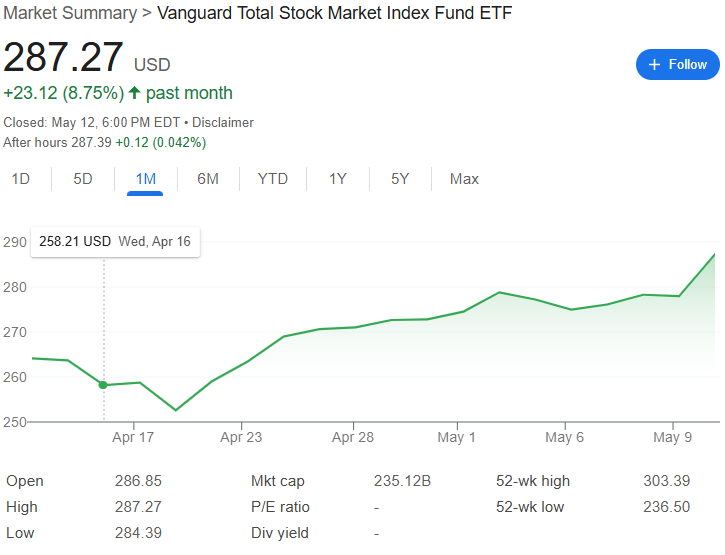

- I took my large rollover of $100,000 into my account and decided to buy shares of VTI. On Thursday morning the price is $258.21 per share.

- Since the ETF is traded on an exchange, I place a buy order at a limit price. I place my order to buy all of my shares of VTI only at the limit price of $250 per share. This means my order will remain open until it is filled or cancelled.

- On Monday April 21 the price on the exchange dips below the $250 share price and I purchase 400 shares at the $250 per share price.

- Monday May 12 is a great day on the market and the value of VTI closes at $287.27 per share. $287.27 X 400 shares equals a value of $114,908.

In less than one month, my purchase of VTI instead of VTSAX has resulted in an increased gain of $3,930! The extra shares I own will continue to gain in value (I hope) and grow this increase in the future.

How Much Higher a Return Will I have by Buying an ETF?

Using the strategy above to buy at a limit price that is lower than the current price seems to me a much better option than “rolling the dice” and buying the index fund at whatever price it happens to close at. Many experts insist that the difference between the two prices is not a big deal over the many years of your investment. I disagree, especially since achieving the difference above took me about one extra minute to decide what limit price to try – and that is it!

Think about it this way: the extra shares you purchase using this strategy will compound just like the rest of your money and eventually result in tens of thousands of dollars extra. I still believe that “time in market” is better than trying to “time the market.” But if I ever need to transfer money between funds or investment companies again I am going to sell using a limit price that is a bit higher than the current price and buy at a price just below the current price.

There is one potential drawback to this strategy – I am counting on some volatility in the market to get to my price. I tried this strategy a few months ago on a different fund that ONLY increased in value and never reached the strike price I set. My limit price was too low, so I never bought the fund and lost out on the gain.

Feel free to start a conversation in the comments section below about how to choose the correct limit price.

Summary

I am not a certified investor, analyst, or anything with an official title. I’m also not an investment professional, and probably spend an average of 30 minutes per month working on my investments. In other words, you probably shouldn’t use this post as investment advice.

On the other hand, my strategy to increase returns by buying ETFs instead of Index Funds worked beautifully and I plan to do this again when making future investments.

Let me know your thoughts on this strategy in the comments below. Will you be trying out this strategy? Do you disagree with any of these ideas?