We recently suggested ways to Stop Wasting Your Money with These 8 Simple Tips, a topic related to Rule 7 of the Personal Kaizen 10 Rules for Life. Our final rule shared how inflation destroys the spending power of your money. Money saved in a bank account (or as cash) is losing value every day. Here are reasons for putting lazy money to work for you with some suggested actions you can take today!

A Lazy Money Case Study

We’ll begin with the story of two young professionals, both with new jobs in January 2017. Bill and Jill both negotiate a $60,000 annual salary ($5,000 per month) with no raises for the five years. Jill rents a modest apartment with a roommate, bikes to work, and invests $1,000 per month in a low-cost index fund as part of her workplace 401k retirement account. Bill rents a fancier apartment and buys a car (with a 3-year loan) so doesn’t sign up for the 401k. Once he pays off his car loan, he saves an extra $500 per month in cash. He sells his car for $8,000 at the end of the 5-years.

At the end of the five years, Bill has $20,000 in cash from 24 months of saving $500 per month and the $8,000 from selling his car. With modest inflation from 2016 to 2021, Bill also has the benefit of interest earned in his checking account. At 0.05% interest for two years this is less than $6 more. Lazy money!

In this simple example, Jill has no cash at the end of the five years but her money has been working! She has the benefits of her 401k investment each month, the company match (100% up to 3% of her earnings), plus the dividends and returns from her relatively safe, low-cost S&P500 index fund.

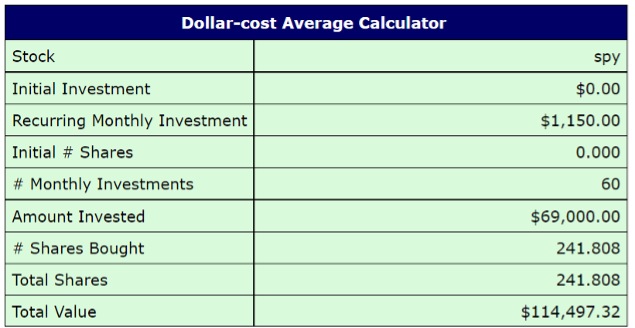

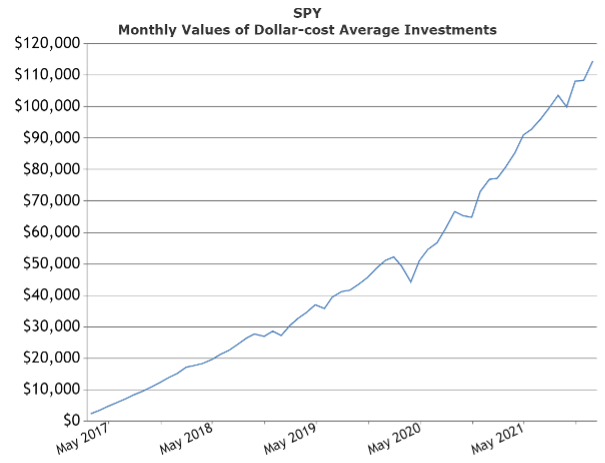

Here is where Jill stands after 5-years of investing her $1,000 per month, plus the $150 match, in the SPY S&P 500 index fund. The chart below is from this site.

This graph shows how dividends and market value of the shares impacted the prices.

Jill put her money to work for her and now has nearly $115,000 towards her retirement! Her money has been hard at work! Bill has $20,000 in cash but that is about it.

Cash is Trash!

Ray Dalio founded and has served as the co-chief investment officer of the world’s largest hedge fund, Bridgewater Capital, for many years. Bridgewater Capital was well regarded for its response to the 2008 global market crash. Dalio has recently written a book about our current global situation, titled Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail.

Dalio is one of the most reputable investors in the world. He recommends we invest our excess money in diversified accounts and avoid holding too much. “Cash is trash,” he states. Investments are risky, but cash is guaranteed to lose its buying power in high inflation periods like we are in now. You can see Dalio explain this in the short clip below.

Steps for Putting Your Lazy Money to Work

Here are a few steps you can take to improve your finances, stop wasting your money, and spend more on what you love. Putting excess, lazy money to work for you is critical!

- Examine your financial picture, including your bank accounts, loans, investments, property, and cash holdings. Tools like quicken or personal capital can simplify this.

- Begin by examining your debts and loans. If you have any short-term, high-interest debt (i.e., credit card debt) pay the full balance on these accounts as quickly as you can. This must be your priority, even if it means you skip spending money elsewhere until these debts are paid.

- Now allocate some money you can access quickly in an emergency. This “emergency fund” is ideally three months of your salary and used as your insurance against risk. If you don’t have an emergency fund, begin saving a small amount of money in a bank account. Even though this is cash, this small amount is valuable. This is because it allows you to save money on wasteful insurance.

- Once you have no credit card debt and a small emergency fund, maximize your investments in retirement accounts through your employer. Be sure to take advantage of an employer match! If your employer matches the first 3% of your pay that you invest be sure to invest at least that 3% so you get the free match! We will cover investment options in a future post.

- Now use a debt reduction strategy to save money on interest. You may also want to consider ways to earn more money in your current job, a new role, or a side hustle.

Summary

How much money are you holding in cash? Is it only for emergencies, or are you watching your cash lose purchasing power as costs increase? Please let us know any actions you will take in the comments below.