We recently suggested ways to Stop Wasting Your Money with These 8 Simple Tips, a topic related to Rule 7 of the Personal Kaizen 10 Rules for Life. Our fifth tip to stop wasting money suggests avoiding paying interest whenever possible – a challenge for most of us since over 75% of American adults have some form of debt. Here are common forms of personal debt and some ways to pay less on interest.

America’s Debt Problem

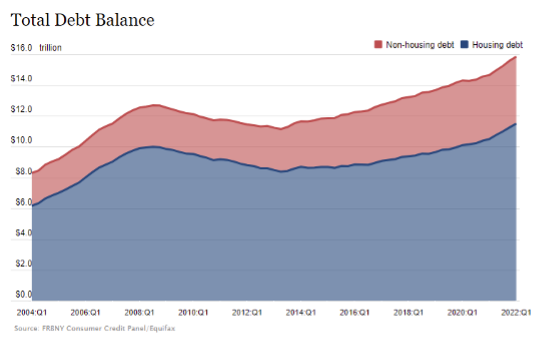

Americans like to borrow money. The total debt balance in the country continues to grow every year. Interest payments on this debt will become an expensive problem as interest rates rise in 2022.

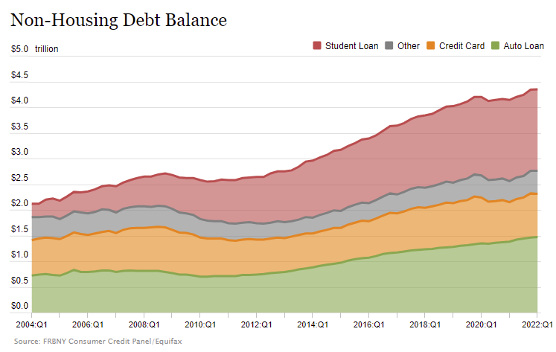

The bulk of American debt is mortgage debt. This chart shows how the rest of the debt is distributed.

This table shows the approximate balances for each debt and typical interest rates as of the first quarter of 2022. The category “other loans” includes consumer finance loans, retail cards, and unclassified loans.

| Debt Type | Total Debt | Typical Interest Rates |

| Home Mortgages | $11.5 Trillion | 3% to 7% typical |

| Student Loans | $1.59 Trillion | 5.8% average (4-7% typical) |

| Auto Loans | $1.47 Trillion | 5% to 20% typical |

| Credit Card Debt | $0.84 Trillion | 17.7% average (but often 29%) |

| Other Loans | $0.45 Trillion | 10% to 28% typical |

Mortgages and auto loans typically have the lowest rates since the home or car is technically owned by the lender as collateral. The lower rates in each range are typically offered to consumers with higher credit scores. We will share more about this important number in a future post.

Debt: Ranked from Best to Worst

Mortgage on Your First Home

This form of housing debt has actually helped many Americans grow their net worth and is usually the last debt you want to repay. The interest (plus taxes and insurance) you pay for your housing is typically in place of what you would need to pay if you were renting a place to live instead. Mortgage rates for the past 10-15 years have also been historically low (averaging under 5%). This has not always been the case, as you can see in the chart below of average 30-year fixed mortgage rates.

College Loans

For some people, college degrees lead to a high-paying job that is easily able to cover the interest cost of a college loan. College loans for these people can be an acceptable form of debt.

Note that some students borrow money for college but never finish their program and earn a degree or other qualifications that allow them to earn more. College loans for these people can be very damaging. College loans are also hard to get forgiven if you ever need to file for bankruptcy (although that may change soon).

Consolidating student debt is common, but we don’t recommend it since it typically results in paying more, not less, interest. Try one of the debt reduction strategies below instead.

Mortgages on Second Homes

Mortgage rates on a second home are likely going to be 0.5 to 1% higher than for a first home. This higher rate means you will pay more interest – it may be better to avoid this expense unless you are renting your second home for money.

Home Equity Lines of Credit (HELOCs)

These loans can be risky and problematic unless they have a clear return on investment. Here are the only times when HELOCs are smart:

- You are borrowing money from your home value in order to repair or improve the property so that you will earn the money back when you sell the house.

- Your rate is low and will allow you to pay off balances on other, higher-interest debt.

- You are borrowing money in order to buy another house, and are positive your existing house will sell for a profit in 30-90 days.

If you aren’t doing the above, avoid HELOCs.

Automobile Loans

Rates on automobiles can become quite expensive. We recommend most people avoid borrowing money to purchase a vehicle. Save up your money and buy a used car instead.

Debt Consolidation and other Personal Loans

A debt consolidation loan combines high-interest debt into one personal loan. These loans can help you afford your debt, or reduce the interest rate but only if the interest rate you can obtain is low enough to make the consolidation worthwhile. We recommend never getting to the point where you need a personal loan, but if you do please reach out to us for help with a debt elimination strategy.

Credit Card Debt

This is the worst form of debt on the list simply because the interest rates on this debt are so high and often for day-to-day expenses that can probably be avoided. We often use credit cards for both everyday and major purchases, but never carry a credit card balance or pay interest. We will share credit card benefits in a separate post.

Debt Reduction Strategies to Pay Less Interest

It is very hard to save money for the future when you have more than one of the loans above. Every monthly loan payment you make includes what you owe for interest (based on the amount borrowed and interest rate) and a small amount of the amount borrowed. You will pay the loan back faster (and save interest) by paying more than just your minimum payment each month.

First, determine how much.

- List out your current debts with the interest rates and monthly payments.

- Examine your budget and allocate as much extra money as you can each month to debt reduction. You may need to cut expenses in some areas until your debt is gone!

- Use this extra money to pay extra on your debt. Two simple techniques are shared below. Choose the method that feels right to you.

The math method

Use this technique if you are disciplined and good at math and spreadsheets. Add the extra money you budgeted each month to the debt that has the highest interest rate. Continue until that debt is fully paid. Now take the extra amount, plus your minimum payment on the first debt, and use this to pay extra on the debt with the second-highest interest rate. Continue until you are debt free!

The snowball method

In this method, add the extra money you budgeted each month to the smallest debt you have. Once you fully pay off that debt, put the money you were paying on that loan towards your second smallest debt. Each debt you eliminate with the snowball method feels great – and gives you more free money to put towards your other debts.

Summary

We hope our readers have minimal debt or are prepared to reduce the debt they have. Please let us know your situation in the comments below and if you’ll be using either of our recommended debt reduction methods!