We previously posted tips on Debt Reduction: Pay Less Interest and More on What You Love and referenced another way to pay less interest – reducing the interest rate lenders require on your debt. This post explains how your credit score is one of the key measures of your financial health and provides tips to improve your credit score and save thousands of dollars.

What is a Credit Score?

Credit scores provide lenders with a way to determine how risky it is to loan money to you. A lower score means higher risk, and means they must charge more interest in case you fail to pay them back. If your score is really low, lenders may decide to not lend you money or let you use their credit at all!

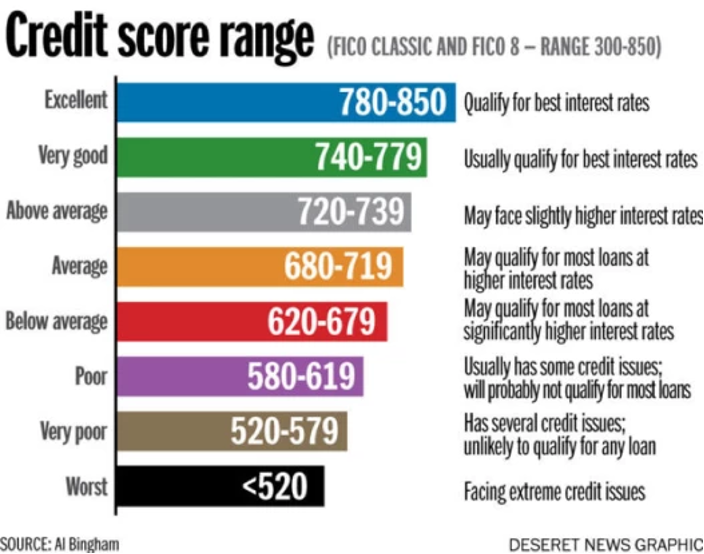

Credit scores in the US are provided by several for-profit companies, including the Fair Isaac Corporation (FICO), Experian, EquiFax®, and Transunion®. Each agency has its own method for analyzing risk that is simplified to a single number. Typical FICO credit score ranges are shown below.

How Your Credit Score is Calculated

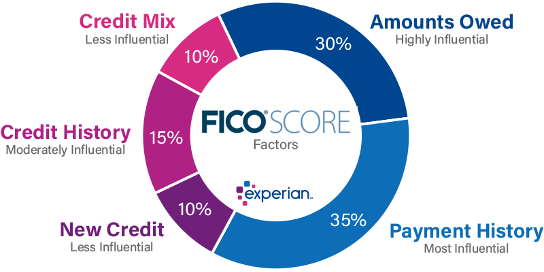

The credit reporting agencies collect information from lenders about how much you are eligible to borrow, how much you have borrowed, and your payment history. Lenders agree to share this information so they have an accurate picture of the borrower’s capacity to repay the loan being applied for – so they understand their risk. Here are the main factors that will affect the borrower’s credit score, in order of importance:

Payment history:

Credit reports will show the borrower’s history of repaying their debts. Have loans ever been defaulted on and not repaid? Have payments been missed? Are payments ever sent late?

Amount of Debt:

Lenders want to know what your current debts are and compare this with what they know about your income and savings. Any new debt will get added to the existing debt and increase your risk of defaulting on the loan. One of the main considerations will be credit utilization – how much of your maximum allowed credit is utilized. If you have three credit cards each with a credit limit of $10,000 then your total credit limit is $30,000. Keeping your debts on these accounts below 30% of your credit limit ($9,000 in this example) is recommended. Utilization below 10% will likely maximize your score.

Length of Credit History:

More data on your credit history will increase the lender’s confidence in the data. Never missing a payment in 20 years of data is better than never missing a payment in two years of data.

Types of Credit:

Your credit mix is a small factor in the data. Lenders will prefer if you have a payment history with their type of debt, and with multiple accounts. A 15-year credit history with multiple accounts and lenders is better than a 20-year credit history with only one debt account.

New Credit:

Another small factor in the data is recent applications for credit. Lenders may see a borrower as riskier when they have applied for multiple loans recently. Does this represent financial trouble not reflected elsewhere in the credit report?

What is My Credit Score?

Many services exist that will charge you money to look into your score. Our advice is to save your money and instead follow the steps for improving your score below.

At some point, you will need to apply for credit for a mortgage or other loan. The lender will check your credit score (and potentially lower your score) as part of their review process. You can ask the lender to share the credit report they obtain and see your score for free.

Simple Steps to Improve Your Credit Score and Save Thousands

Now that you understand the basics of how your score is calculated, here are some basic steps you can take to improve your credit score:

Pay your bills on time:

This is the most important factor in your credit score. We recommend setting up automatic payments on all your debt. Have your loan payments deducted automatically each month so you are never late on a payment. Also, set up automatic payments of the full balance on any credit card every month.

Build your credit history:

You will not have a credit score until you have some history. If you are young or have had very few debts in the past you need to apply for one (or more) free credit cards and only use them sparingly. You may not get accepted or get good terms on your first few cards. That is okay, you will need at least 6 months to build a positive history. A higher score then will get you a better offer.

Use our debt reduction strategies:

Pay off your debts using one of our strategies. If you don’t have any debt, avoid bad spending habits that put you in debt in the first place!

Review your credit report:

All of us can access a FREE detailed credit report once a year through AnnualCreditReport.com. A detailed credit report will show month-by-month payment status, every lender you’ve borrowed from, and their contact information. Be sure to request your reports annually and look for any errors in the report. The US Consumer Financial Protection Bureau has recommendations on how to fix credit report errors.

Keep old accounts open:

Reviewing your annual credit report may remind you about old accounts that are still open. Don’t be too quick to close them since your score benefits from your length of credit history.

Take Action

When you follow the steps in this post you are guaranteed to raise your credit score. This will help you get better interest rates on loans to save money on interest and qualify you for credit cards with bonus points and cashback. We will teach you how to Take Advantage of Bonus Points and Cashback in our next post.