The Personal Kaizen posts over the past several weeks have been focused on smart money habits related to Rule 7 of the Personal Kaizen 10 Rules for Life. We began by encouraging you to Stop Wasting Your Money with These 8 Simple Tips and gave advice on How to Improve Your Credit Score and Save Thousands and last week ways to Use Credit Card Bonus Points and Cashback. This post will provide step-by-step instructions that will allow you to travel the world for free.

Want to Travel for Free?

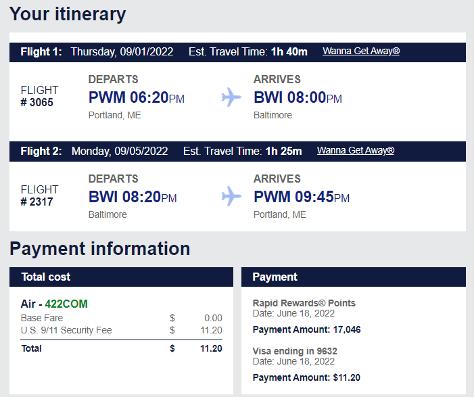

I booked hotel rooms and bought plane tickets for a vacation for two today and only spent $22.40! My wife and I will spend Labor Day weekend (Thursday night to Monday night) in downtown Washington DC. Here are the bills (the second flight is not shown but was also $11.20 using a Southwest companion pass):

I was able to do this using credit card points accumulated through my regular spending over the past year. Here are the steps to take so you can do the same.

1. Build your credit score to at least 700

The only way you will be able to follow the steps below is with a decent income source and a good credit score. If your credit isn’t high enough to qualify for the credit card offers below then follow the steps in our post on How to Improve Your Credit Score and Save Thousands.

2. Plan your future trip!

While you build your credit score, plan the trip you want to take.

- Where will you fly from and with which airlines?

- Where will you visit?

- What hotels are located in the area?

Making the plans for your trip can be one of the best parts. Do this alone or with a travel companion and know the travel and rooms can be free!

Note that you will need to plan ahead in order to travel for free using points. Most of the methods for earning bonuses require at least 2-3 months (or more) before you will have the points in your account. You then will get the best deals by scheduling your trip at least 3 months in advance, and much further in advance if you are traveling internationally.

3. Fly for Free

Our advice for flying using points is easy if Southwest is an option and complicated otherwise.

Flying Southwest:

I have used Southwest miles for the past five years and traveled for free many times. Apply for one of several of the Chase Southwest Rapid Rewards cards. There are three cards offered in 2022 with different annual fees and bonus points allotted. Apply for a card that fits your spending needs.

Southwest also offers a Rapid Rewards business card with a very attractive bonus offer. As long as you have any small side hustle you can apply for the card and earn the bonus. You can see current bonus offers and apply for any of these Chase airline cards at this link.

This post recommends several specific credit cards. We do this to help you travel for free and improve your life and are not compensated by these companies in any way.

Flying all other airlines:

If you want to fly to places Southwest doesn’t reach you are likely best served by earning points that can be transferred to multiple airlines. Two of the best cards for this purpose are shared below:

Chase Sapphire Preferred. This card has a bonus worth 60,000 points that can be transferred to multiple partner airlines or hotel programs (sometimes with a 25%- or 50%-point bonus). The card also offers several additional travel perks worth looking into.

American Express Cards. Several cards have bonus offers that might be worth the fees. Click on the link to see options. We currently aren’t using any of these Amex travel cards.

Citi Premier Card. This card again offers bonus points that can be transferred to multiple partner airlines or hotel programs. This is a card we will likely apply for in the near future.

Apply for one or more of these cards and be sure to spend enough to meet the requirements of the bonus offer! Never spend extra with your card! Instead, only apply for one card at a time and use that card exclusively until you obtain the bonus. Always log in and set up autopay so your full balance is paid every month. If this is unaffordable to you, we recommend you Stop Wasting Your Money with These 8 Simple Tips first! Leave a comment if you want us to share advanced spending strategies you can use to earn the bonus.

Once you have earned the bonus points you can identify the lowest-cost flights to your vacation destination (using points) and then transfer enough points to the airline program.

4. Earn a Southwest Companion Pass and Two Can Fly Free!

Southwest Airlines offers a great bonus for frequent fliers – a companion pass that allows someone to fly with you for free! The pass is for one person only, but you are allowed to change the person several times per year.

You earn the pass by earning at least 130,000 airline points in a single year. This is a lot of flying – or just some moderate spending with credit cards. The best part is that you can use the pass for the rest of the year it is earned, and the entire next year!

Here is how I have earned the companion pass:

- Apply for both of the Chase Southwest cards shown above. I did this in November and planned my spending to achieve both bonuses in January or February of the following year.

- You will earn 130,000 in bonus points (50,000 + 80,000) plus a bit extra from the spending (as of July 2022 these cards would earn 155,000 points respectively).

- Wait a few weeks for the points to be added to your account and to receive your companion pass.

The best part about having the pass is you have tons of points to use for your ticket, and the second ticket is free!

5. Get Points with a Hotel Partner

Once your airline points are earned and your trip is booked you will want to get to work on earning points for a free hotel room. We recommend two credit cards offered through Chase that will provide plenty of options for most people.

Marriott Bonvoy Visa. Marriott had over 7,300 properties in 134 countries at the end of 2019. You are likely to find a hotel that fits your needs wherever you want to go, and often will be able to choose from one of their 30 brands. Using these credit cards will earn you points, but the bonus is the best way to travel for free. Most bonus offers will be enough to stay at least five nights for free!

IHG Premier Rewards. InterContinental Hotels Group (IHG) has over 5,600 properties in 100 countries and includes brands like Regent, Kimpton, Staybridge Suites, and Holiday Inn. The current bonus offer is for 140,000 points – our example above used 76,000 points to stay four nights in a Holiday Inn in downtown Washington DC.

You can see current bonus offers and apply for both of these cards at this link.

6. More Ways to Travel for Free

Here are a few expert tips that will help you earn even more bonus points:

- Spouses should never share a card. Always decline to have your spouse as an authorized user. In the future, you can refer your spouse (for more bonus points) and they can obtain their own points! In my example above, I provided the points for the plane ticket while my wife used her points for the hotel.

- Schedule in advance to cancel your card just before the end of the first year or the second year of the card. The cards we recommend all have annual fees on the account anniversary date. Most cards permit you to reapply and obtain a bonus if it is at least 24 months since the last time you received that bonus. I have earned a Southwest companion pass multiple times by using the strategy shared above!

- As mentioned earlier, avoid these strategies if you don’t spend enough to earn a bonus or your income isn’t high enough to pay the balance in full each month. Banks and credit card companies offer these bonuses to entice people to switch to their card(s) and earn them money. Don’t let them win!

Summary

Ask questions or share additional strategies on ways to travel for free in the comments below.