Bill Perkins wrote Die with Zero – Getting All You Can from Your Money and Your Life in 2020 and it has become a highly recommended book. Dying with zero is about both money and time. We all need to think more about how we use our limited time on earth and live our best life. The goal is not to be as rich as possible; the goal is to maximize your total life enjoyment.

This post summarizes key points from the book and shares some simple tools that will help you maximize your total life enjoyment.

Rules from the Book

Perkins shares nine rules to follow in Die with Zero – Getting All You Can from Your Money and Your Life.

- Maximize your positive life experiences. Start thinking about what life experiences you’d like to have and the number of times you’d like to have them. Perkins wants us to focus more on experiences than on money.

- Start investing in experiences early. “Early” means right now. The earlier you gain your experience the more you can benefit from it over the course of your lifetime.

- Aim to die with zero. It is easy to make work a habit. Earn enough to have a rich life of experiences, but no more.

- Use all available tools to help you die with zero. Use a life expectancy calculator to estimate how many years of experiences you have left. Consider using an annuity to ensure you will never run out of money.

- Give money to your children or to charity when it has the most impact. Learn more below.

- Don’t live your life on autopilot. What life experiences can you have now that you might not be able to have later?

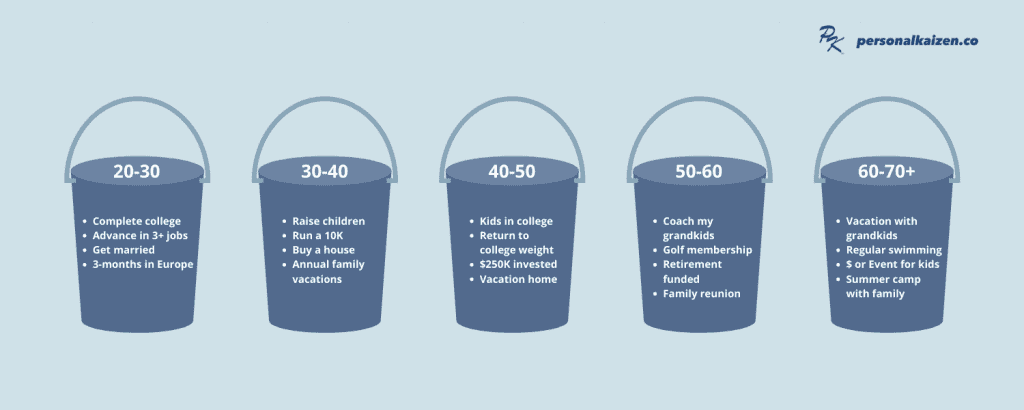

- Think of your life as distinct seasons. Learn more about time bucketing below.

- Know when to stop growing your wealth. Your peak is a date, not a number. Perkins suggests this date is between 45 and 60 years of age (for most).

- Take your biggest risks when you have little to lose. You are better off taking more chances when you are younger. Choices reflect your priorities, so choose deliberately!

What About the Kids?

One of the main excuses given for over-saving during your working years is providing for children. Perkins recommends you have a tiny inheritance (or die with zero) and instead allocate the money you want to give to your kids and give it to them while you are still alive (and when they are younger and need it more). This way you have separated out your money and their money and can spend your money down to zero.

The Federal Reserve Board shows that the most common age to receive an inheritance is 60. Author Perkins ran an informal poll and found the optimal age for a child to receive money from a parent was between 26 and 35 years of age, when they are not too immature to blow it but also before they have created their own income streams.

Time with your kids (especially when they are young) may be more important to them than the money you leave them later. I am living this input – as I write this post, I am enjoying a vacation in the Dominican Republic with my oldest child. The two of us will spend over a week together exploring the country and creating memories.

Be intentional with your kids and give them the money you wish to bequeath them before you die. Dead people can’t give money away. Perkins’s input on leaving money to charity is the same as with children. Better to give the money while you are alive and can help influence how your money is spent!

Time Bucketing

People need health, time, and money for great experiences but we often don’t have them all simultaneously. When we are young, we have health and time but little money. When middle-aged, we often have health and money but little time. Then we retire and have time and money but less health and energy.

Bucket lists are a popular tool for listing out experiences you want to have before you “kick the bucket.” Perkins recommends “time bucketing” instead – so you can time your experiences for optimal effect. Do your skiing when you are young and healthy (and recover quickly) and wait till you are older to play golf and go to the theater. Perkins also notes the benefit of having experiences earlier. What if you get sick, hurt, or die? Also, it is better to have a profound, “life-changing” experience when you are young and still have time to change your life!

Here is an example of a simple time-bucketing exercise:

Important Strategies to Die with Zero

Calculate your survival threshold: Perkins suggests a simple way to estimate how much you need to save to not run out of money (but not have extra either):

0.7 X (Cost to live one year) X (estimated years left to live)

For example, assume you will live on your social security benefits and $2,000 per month ($24,000 per year) after you retire. If you begin using your savings at 65 years old and expect to live to 90 then you have 25 years of expenses to cover. 0.7 X 24,000 X 25 = $420,000.

This number is lower than most retirement calculators suggest – which is why Perkins notes most people die with much more than zero!

Don’t delay events: Perkins describes throwing a 45th birthday bash that included his family and friends. He purposely did this at age 45 rather than 50 and was happy he did. People close to him had five extra years to relive the memories of the trip. In addition, multiple people had health and family changes that would have prevented them from going on the trip if he had waited five more years.

“I have never seen somebody’s total net worth posted on their tombstone.”

– Bill Perkins

Projecting Your Expenses: As you plan your future spending realize that you will want to spend more in your fifties than in your sixties, more in your sixties than your seventies, and more in your seventies than in your eighties. As your health declines later in life your needs often will decline as well.

Avoiding death: Don’t spend tens or even hundreds of thousands of dollars to prolong your life for a few more weeks. This is giving up years of your life working when you are young and healthy for time when you are sick and likely immobile.

We hope you found some of these rules interesting and helpful. Here’s to living now and dying with zero!